Vision: a world where everyone has a decent place to live

Mission: seeking to put God's love into action, Habitat for Humanity brings people together to build homes, communities, and hope

Mission: seeking to put God's love into action, Habitat for Humanity brings people together to build homes, communities, and hope

HistoryGreater Green Bay Habitat for Humanity was started in the community in 1987. In our 37 years, we've built 137 homes in Brown County, impacting 214 adults and 384 children.

37 Year Growth 1987 - 2012 (25 years) - 63 homes (49%) 2013 - 2017 (5 years) - 42 homes (33%) 2018 - 2022 (5 years) - 23 homes (18%) 2023 - PRESENT - 9 homes & counting |

Greater Green Bay Habitat Programs

homeownership program

Habitat builds homes and sells them to qualified applicants at no profit. We do not give away homes! Homeowners benefit from simple, decent, affordable housing, and the community benefits from an increase in tax revenue. Learn more here.

ReStore

The ReStore is a retail operation that collects and sells donated home goods and building materials. Profits from the ReStore are used to build homes in Brown County. Learn more here.

Habitat builds homes and sells them to qualified applicants at no profit. We do not give away homes! Homeowners benefit from simple, decent, affordable housing, and the community benefits from an increase in tax revenue. Learn more here.

ReStore

The ReStore is a retail operation that collects and sells donated home goods and building materials. Profits from the ReStore are used to build homes in Brown County. Learn more here.

Impact

|

707 volunteers donated 27,951 hours

|

Our homeowners pay $435,237 in property taxes each year, adding a total of $23.6 million to the tax base since 1987

|

$1.9 million is spent annually with local suppliers and contractors

|

over 15.5 million pounds of material has been diverted from landfills since 2009

|

*impact numbers reflect information and data recorded in Greater Green Bay Habitat for Humanity's fiscal year 2023-24 that runs July 1st through June 30th annually.

why housing matters

The State of the Nation's Housing - 2022

Joint Center For Housing Studies of Harvard University

Joint Center For Housing Studies of Harvard University

|

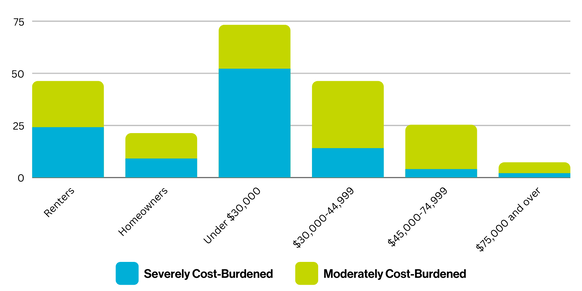

According to the recent collection and analysis of housing data, the Joint Center for Housing Studies of Harvard University provided greater insight into the ongoing affordability crisis. According to the study, job and income losses early in the pandemic increased the affordability challenges for millions of households already struggling to pay four housing. In 2020, the nationwide share of cost-burdened households paying more than 30% of their incomes for housing was 30%. In addition, 14% of households were severely cost-burdened and spent more than half their incomes for housing.

|

Renter households were particularly hard-pressed with 46% considered moderately burdened and 24% severely cost-burdened. These indicators reflect the first substantial uptick in national cost-burdened rates in 10 years.

Also indicated in the study, the spike in inflation has compounded the pressures on these financially stressed households. The cost increases were especially large for necessities such as food, in-home energy and gasoline. Further adding to the challenges that cost-burdened households face during a housing crisis.

Also indicated in the study, the spike in inflation has compounded the pressures on these financially stressed households. The cost increases were especially large for necessities such as food, in-home energy and gasoline. Further adding to the challenges that cost-burdened households face during a housing crisis.

|

The MacArthur Foundation released results from a survey of U.S. adults conducted to inform the work of the Foundation’s How Housing Matters initiative. The results of the survey reveals that the concerns and challenges related to affordable, quality housing are very real for many Americans.

tradeoffs

More than half of all adults have made at least one tradeoff in the past three years to cover their rent or mortgage. Tradeoffs include taking second jobs, cutting back on health care and healthy food, and moving to less safe neighborhoods. challenges In every region of the U.S., anywhere from 53 to 69 percent of adults classify the purchase of affordable housing as challenging in their community. limits Fifty-eight percent of adults say that a family of four with an income of about $50,000 would have a hard time finding affordable quality housing. That number skyrockets to 88 percent for a family of four with an income closer to $24,000. unaffordable Most believe that friends and family who are getting older will face challenges meeting their housing needs. Sixty-five percent of adults highlight affordability as a top issue, second only to an individual’s physical needs as they age. |

impact of adequate housing

Housing is central to ending the cycle of poverty and it can play a key role in positively influencing a family’s education, employment, and health opportunities.

freedom

Adequate shelter is a critical foundation for breaking the cycle of poverty.

community

Decent shelter contributes to thriving school systems, community organizations and civic activism.

stability

Safe homes and neighborhoods help to build social stability and security.

good for all

Adequate housing is key to the health of the world’s economies, communities and populations.

development

Good housing attracts economic investment and development.

resources

Homeownership is a form of wealth accumulation through equity and forced savings from mortgage repayment.

freedom

Adequate shelter is a critical foundation for breaking the cycle of poverty.

community

Decent shelter contributes to thriving school systems, community organizations and civic activism.

stability

Safe homes and neighborhoods help to build social stability and security.

good for all

Adequate housing is key to the health of the world’s economies, communities and populations.

development

Good housing attracts economic investment and development.

resources

Homeownership is a form of wealth accumulation through equity and forced savings from mortgage repayment.

What We Believe.

At Greater Green Bay Habitat for Humanity, it is embedded in our mission to unite as one community with the vision that everyone, no matter who we are or where we come from, should have the opportunity to embrace strength, stability, and self-reliance through affordable homeownership. We are committed to making our community a true reflection of the mission and vision of Habitat for Humanity.

Equal Housing OpportunityWe believe that everyone deserves a safe, decent, and affordable place to call home. Our commitment to equal housing opportunity ensures that we serve all individuals and families regardless of race, religion, gender, sexual orientation, age, disability, or economic status. By advocating for fair and inclusive housing practices, we strive to eliminate barriers to homeownership and create a diverse and vibrant community.

|

Non-ProselytizingOur work is driven by a passion to build homes, communities, and hope, not by a desire to promote a particular faith. We do not proselytize, nor do we require our volunteers, partners, or beneficiaries to adhere to any specific religious beliefs. Our inclusive approach ensures that everyone feels welcome and respected, fostering a spirit of collaboration and mutual respect in all our efforts.

|

Here For AllWe are dedicated to creating an environment where everyone feels valued, heard, and supported. Our commitment to diversity, equity, and inclusion means that we actively work to address and dismantle systemic inequalities within our organization and the broader community. By embracing a wide range of perspectives and experiences, we aim to build stronger, more resilient communities where everyone can thrive.

|